Bitcoin maxi bros have been smugly watching from the sidelines as DeFi degens gamble away their ETH inheritance. But the party’s might be coming to Bitcoin town, and it’s bringing fungible tokens that don’t completely suck. Runes: Casey Rodarmor’s sequel to Ordinals that lets you token without nuking the entire mempool. It’s like watching your straight-edge friend finally learn how to shotgun a beer….surprising, slightly concerning, but also kind of impressive.

What Are Bitcoin Runes?

Bitcoin Runes represent an innovative protocol for issuing fungible tokens directly on the Bitcoin blockchain. Created by Casey Rodarmor, who also developed the Ordinals protocol, Runes were designed to improve upon the BRC-20 token standard by offering a more efficient and scalable solution.

Unlike their predecessors, Runes leverage Bitcoin’s Unspent Transaction Output (UTXO) model rather than an account-based model. This fundamental difference enhances efficiency, security, and scalability while minimizing onchain footprint. All Runes data is stored completely onchain using the OP_RETURN opcode, ensuring full transparency and immutability.

A key feature of Runes is their simplicity …they are not arbitrary smart contracts. Instead, each Rune has a small number of unchangeable parameters that are set at creation, including name, symbol, ID, supply amount, and divisibility.

What means:

- A more efficient way to make custom tokens on Bitcoin

- Fully stored on Bitcoin’s blockchain

- Simple with fixed properties like name and supply

- Not complex smart contracts, just basic tokens

They improve on previous Bitcoin token methods by using Bitcoin’s natural transaction system to save space and work more efficiently.

How Runes Work

The Runes protocol operates through several key components and processes:

- Etching: This is the process of creating a new Rune token and defining its attributes. It’s the foundational step that establishes the token’s identity and parameters. (for Ethereum normies this is basically the minting step)

- Minting: After etching, tokens can be minted through either open or closed systems. Open minting allows anyone to generate new Runes, while closed minting restricts token creation to predetermined conditions. (Ethereum bros, this is the buying step).

- Edict: This is a transaction command or script that handles the transfer of Runes between addresses.

- Runestone: These are protocol messages stored in a Bitcoin transaction output that contain instructions for the Rune tokens.

- Rune ID: Each Rune is identified by the block in which it was etched and the index of the etching transaction in that block, represented as BLOCK:TX.

A significant advantage of Runes is that each UTXO can hold different amounts or types of Runes, greatly simplifying token management. This contrasts with BRC-20 tokens, which create a new inscription every time they are deployed, minted, or transferred, with each token stored in a separate UTXO.

what means

Runes let you store many different tokens in one place. BRC-20 tokens required a separate container for each token. It’s like having one wallet for all your coins versus needing a different wallet for each type of coin.

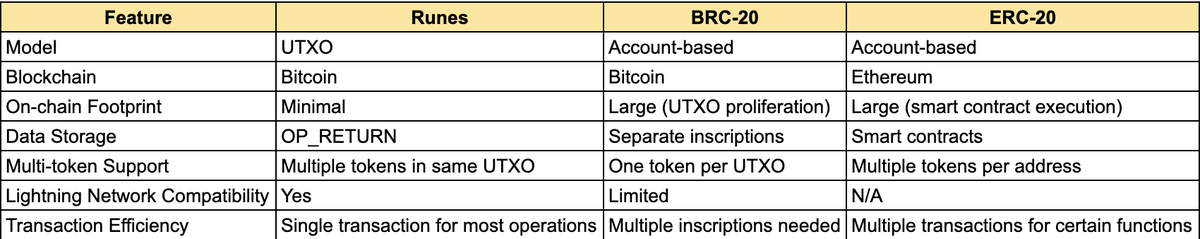

Runes vs. BRC-20 vs. ERC-20

Runes offer several improvements over BRC-20 tokens:

Current State and History

Casey Rodarmor introduced the idea for Runes in September 2023, with the protocol officially launching on April 19, 2024, coinciding with the Bitcoin halving at block 840,000. The launch created significant excitement, leading to a surge in Bitcoin transaction fees, with the average fee reaching $127 on the day of the halving.

Currently, Runes are primarily used for creating and trading meme coins. The initial excitement was substantial but quickly waned, with a 99% decrease in daily etchings within a month of launch, the early hype hasn’t yet translated into sustained usage.

Potential for Runes

The potential impact of Runes on the Bitcoin ecosystem could be transformative in several ways:

Financial Innovation

- Runes could enable the issuance of stablecoins, security tokens, and other financial instruments directly on Bitcoin

- They may bring significant liquidity back to Bitcoin, enhancing its utility beyond being a store of value

- Additional fee revenue from Runes transactions could incentivize miners, increasing network security

DeFi on Bitcoin

Similar to how ERC-20 tokens fueled Ethereum’s DeFi boom, Runes could establish Bitcoin as a legitimate platform for:

- Decentralized lending and borrowing

- Asset tokenization

- Advanced trading mechanisms

- Yield-generating protocols

Gaming Integration

- In-game assets, currencies, and rewards could be represented as Runes

- This would enable blockchain-based games (say focg) with true ownership of digital assets on Bitcoin’s secure network

Privacy Enhancements

While still theoretical, Runes might be used to implement privacy-enhancing features in Bitcoin transactions, creating a new class of privacy tokens with Bitcoin’s security backing

Layer 2 Ecosystem Growth

Runes are expected to become the dominant fungible token standard not just on Bitcoin but also across Layer 2 solutions, creating a unified token standard that spans the entire Bitcoin ecosystem

Global Adoption Acceleration

By expanding Bitcoin’s utility beyond simple value transfer to include complex tokenization applications, Runes could help Bitcoin achieve its goal of widespread global adoption

Challenges

Despite the exciting potential, several challenges face the Runes ecosystem:

- User Experience: The current process for interacting with Runes is very clunky or heavy centralized. Liquidity is extremely fragmented due to missing aggregators.

- Technological Maturity: As a new technology, Runes haven’t been battle-tested, making them susceptible to potential bugs or vulnerabilities

- Competition: Runes must secure wider support from exchanges as well as ecosystems and compete with established token standards on other chains

- Scalability: Bitcoin’s underlying limitations in block size and transaction throughput could potentially constrain Runes’ growth if not a magic L2 helps with that

- Regulatory Uncertainty: As with all cryptocurrency innovations, evolving regulations could impact Runes’ development and adoption

Soooooo…..

So here we are ….Bitcoin, the chain that was supposedly too pure for shitcoinery, might be spawning more dog tokens than a kennel club convention.

That UX nightmare I mentioned? Starknet’s swooping in like the repair guy who fixes your garbage disposal while judging your food waste. We might have some plans to improve the Runes trading experience. Starknet’s tech could give Runes the security boost and slick interface that Bitcoin’s base layer can’t provide alone.

Will Runes revolutionize Bitcoin or just clog the mempool with more speculative crap? Probably both. For every legit stablecoin project, expect fifty ElonCumRocket tokens to make validators rich and retail rekt. That’s not a bug…it’s a feature of any open financial system.

Those who write off Runes as a meme could be ignoring the next big on-ramp to Bitcoin utility. Or maybe it’s just another crypto science experiment that dies quietly after the initial hype.

Either way, watch your back and don’t get rekt.

Leave a comment